Welcome to the Plastic IQ Solutions Database,

a guide to technologies, strategies, and best practices for reducing plastic waste

CHOOSE YOUR SOLUTION

Eliminate plastic items

Minimize plastic

per item

Reuse models

Paper

Compostables

Glass

Metal

More recyclable formats

Enhance

recyclability

Bio-based content

Mechanically

recycled content

Chemically

recycled content

More recyclable formats

Building a more robust recycling system requires using packaging formats that can navigate the full recycling system and find a path to a viable market post-recycling. Plastic IQ distinguishes two solutions to increase the recyclability of plastic packaging:

Switch to more recyclable formats and/or polymers, such as moving from multi-material to mono-material items, shifting to more commonly recyclable polymers, or changing from a small-format item (that may be lost in the recycling system) to a larger-format item.

Design to enhance packaging recyclability (within the same polymer and format) by ensuring packages comply with “APR preferred” guidelines. For this solution, see the separate Solutions Database page on “Design to enhance recyclability.”

The following are used for general information and illustrative purposes and do not reflect a preference of or an endorsement by The Recycling Partnership or our affiliates or vendors.

For rigid packaging, Walmart’s Recycling Playbook suggests switching packages made from acrylic, PETG, PVC, PS, and multiple materials and focusing on PET, HDPE, LDPE, and PP. In addition to switching resin, there are some cases in which changing to a different format can also increase recycling acceptability and recovery, such as ensuring the packaging size is not too small to be sorted at materials recycling facilities (MRFs) or switching to a bottle format in the case of PET and HDPE.

Curbside recycling of flexible packaging is currently quite rare but return-to-retail programs are widespread for PE-based films and bags. A small portion of the U.S. has access to plastic film recycling at curbside. The Materials Recovery for the Future (MRFF) project demonstrated that flexible packaging could be removed from a single-stream facility, improving the quality of the paper bales and creating a new bale type (1). However, significant investment is needed in the system to make curbside plastic film recycling more than just a pilot project.

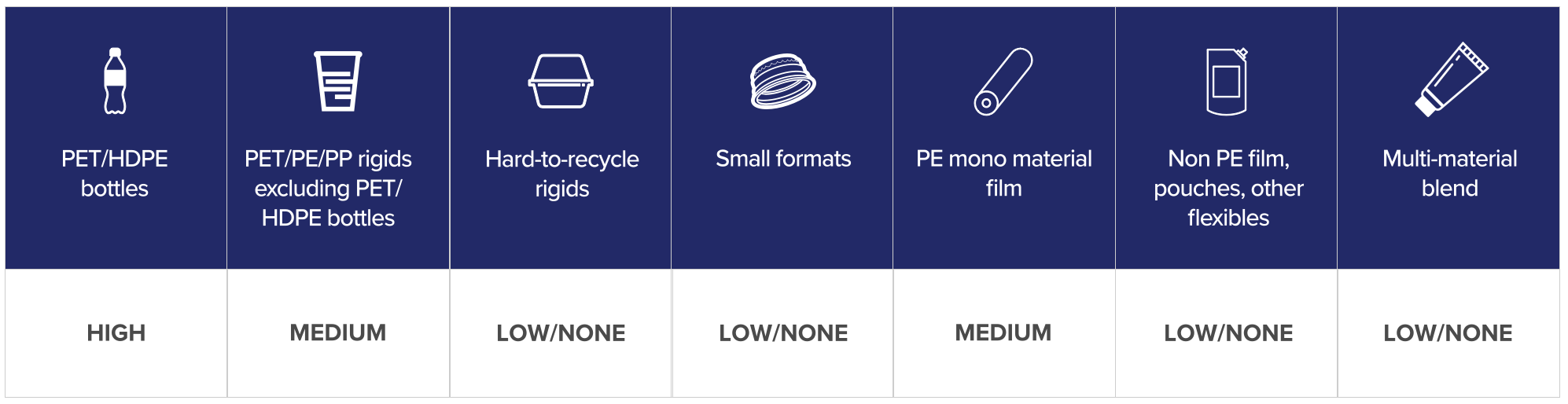

The table below shows typical recyclability (at scale) of well-designed packaging in each of Plastic IQ’s seven packaging types in the U.S. market. Using the Plastic IQ Tool enables switching from any “Low” cell to “Medium” or “High,” or from any “Medium” cell into “High” (PET/HDPE bottles) to see how switching to more recyclable formats can make a difference.

This lever is likely to be used in conjunction with the Enhancing Recyclability and Substitute levers. For example, in many cases, eliminating certain plastics from a company’s packaging portfolio can involve changing labels, shrink sleeves, or layers in a cap, which fall under the Enhancing Recyclability lever. Similarly, switching from a PVC plastic blister pack to a paper blister pack falls under the paper Substitution lever.

Companies that joined the U.S. Plastics Pact have committed to ensuring that 100% of their packaging is recyclable, reusable, or compostable by 2025. Switching out of the “Hard-to-Recycle” formats (i.e., other polymer rigids, small packaging formats, non-PE film, pouches, other flexibles, and multi-material blends) can help meet that target by increasing a package’s recovery and recycling rates.

The Walmart Recycling Playbook recommends transitioning out of PS (both rigid and foam). Examples of this type of transition might include converting EPS egg cartons to PET thermoform (3) or molded paper; transitioning yogurt containers and other tubs to PP; moving rigid PS clamshells to PET; and changing PVC blister packs to PET (4) or paperboard boxes.

Mono-material PE film is increasingly available in formats that can, in many cases, provide similar barrier properties to multi-material films, including stand-up pouches (5) and produce bags (6). While, in the U.S., mono-layer PE film currently has the highest acceptability in return-to-retail programs nationwide, mono-material PP film may also one day become acceptable in parallel programs as its usage grows.

The cost of switching packaging format will vary depending on the details of each specific case. Where the costs of moving to a more recyclable format are high, companies may want to evaluate solutions in other levers, such as adopting reusable packaging models or substitution with non-plastic materials.

Increasing the recyclability of a package is likely to lead to reductions in GHG emissions at end of life, as recycling a product helps avoid the high emissions associated with virgin, fossil fuel-based plastic. Production-stage emissions do not tend to increase or decrease much compared to producing non-recyclable formats, as long as a similar weight of plastic material is used. The key is to avoid switching from a lightweight plastic format to a heavy one wherever possible, as this could increase emissions. Companies are encouraged to conduct an individual life-cycle analysis (LCA) to help understand the trade-offs between production and end-of-life emissions.

Current applicability per plastic type

Note: High in this instance implies the solution is highly applicable to the plastic type. Medium indicates potential to apply this solution to the relevant plastic type in some cases, but there are obstacles. Low implies major barriers and this solution generally cannot be used in conjunction with the plastic type.

- Closing the loop by increasing supply of feedstock to make recycled plastics: Having sufficient quantity and quality of recyclable feedstock is a prerequisite for being able to purchase a large quantity of high-quality recycled content. Companies that have committed to a high share of recycled content in their products depend on the availability of sufficient recyclable packaging to meet this commitment.

Enabling the circular economy: Increasing the share of recyclable formats in the waste stream and streamlining the diversity of packaging formats are among the most important levers for improving recycling economics and helping to scale up the recycling industry. Many of the benefits of a robust circular economy – reductions in resource extraction, GHG emissions, costs, waste, and environmental pollution – can be enabled by shifting to recyclable formats.

Responding to consumer expectations: Committing to 100% recyclable, reusable, or compostable packaging is becoming the new norm. Companies that introduce non-recyclable packaging into the market potentially risk losing certain groups of consumers.

- Make the switch: Develop a plan to eliminate non-recyclable formats. For rigids, companies should consider migrating toward PET, HDPE, and PP. For flexible packaging, many products may be able to shift to mono-material PE solutions.

Consider tradeoffs: Moving from flexible to rigid or shifting between rigid resins may enhance recyclability but may also add cost and/or additional weight to a package, potentially increasing the GHG emissions. It is important to also consider other levers, such as elimination or reuse, if a switch to a more recyclable format will cause negative impacts. Companies are encouraged to better understand their options and potential trade-offs.

Share innovations: A unique design in a product category can be challenging for recycling programs to accept and adopt simply because it is difficult to explain to consumers. By making solutions available to others, it may be possible to shift entire product categories, making the change more widespread and acceptable. For example, after several years of development, Colgate Palmolive developed a new solution for toothpaste tubes that eliminated an aluminum component present in most toothpaste tube designs. Colgate made the intellectual property associated with the design freely available in the hope that all toothpaste tubes will be migrated to the more recyclable design. Such category transitions also require investments in the system to ensure that MRFs will accept the new material.

Released in 2022, Walmart’s Circular Connector connects companies with sustainable packaging resources, suppliers, and innovative design ideas to shift to more recyclable formats or substitute to other materials. Companies that develop innovative packaging, components, or supply sustainable packaging materials can submit their product information to Walmart through the intake form. Walmart partnered with the U.S. Plastics Pact’s Sustainable Packaging Innovation Award program to recognize certain innovations.

- Consistency across product categories: Subject to antitrust rules and regulations, it is important for brands to collaborate to help create clarity for consumers about the recyclability level of packaging for particular products. Most education efforts around recycling are based on either package/product types (e.g., soda bottles) or resin types (e.g., PET), but many consumers remain unsure about exactly what and how to recycle. Consistent formats across brands and companies make it easier for consumers to recycle the packages.

Broad adoption of recycling labeling: While more and more brands are adopting the use of recyclability labels, this trend must continue. It is critically important that consumers can easily identify which packages are recyclable as well as which ones are not – especially as product categories evolve to more uniform material usage.

Stronger markets for certain formats, including PET thermoforms: While PET bottle grades enjoy strong markets, PET thermoform markets are still developing although research shows that circular, thermoform-to-thermoform recycling is possible (7).

Greater acceptance for PET thermoforms and PP: While most MRFs accept PET and HDPE bottles, the acceptance for PET thermoforms and PP needs to expand.

References and further reading

(1) MRFF – Research Results 2020. (Link)

(2) The Recycling Partnership – National Capital Needs Report. (Coming soon)

(3) Different carton. (Link)

(4) Blister switch. (Link)

(5) TC Transcon. (Link)

(6) Printpack. (Link)

(7) NAPCOR 2020, Thermoform Recycling. (Link)

(8) APR Design Guides. (Link)

(9) ASTRX Toolkit. (Link)

(10) How2Recycle Guide to Recyclability. (Link)

(11) Walmart’s Recycling Playbook (2019). (Link)

(12) Walmart’s Circular Connector (2022). (Link)

(13) U.S. Plastics Pact’s Sustainable Packaging Innovation Award (2023). (Link)